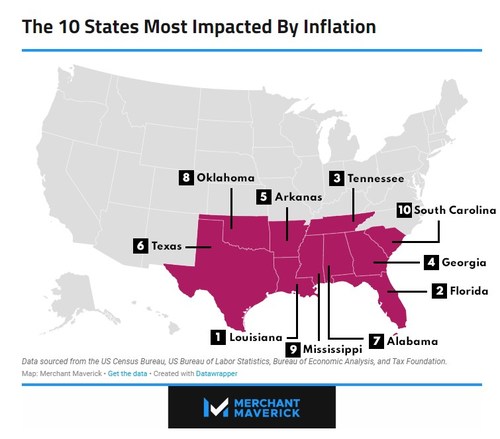

The South Is Getting Hit Hardest by Inflation

These are the 10 States Where Inflation is Hitting Consumers Hardest

ORANGE, Calif., June 21, 2022 /PRNewswire/ — The South has warm weather, great music . . . and some of the worst inflation rates in the country. That’s one of the surprising results researchers uncovered in MerchantMaverick.com‘s "10 States Where Inflation is Hitting Consumers Hardest" report. The full study is available HERE:

Inflation is hurting everyone. And water is wet. But, while prices are rising, they’re not rising at the same rate throughout the country. Add to that the fact that states have different average household incomes, sales tax rates, and other variables. The result? Huge differences in the way inflation is impacting consumers.

MerchantMaverick.com, the business product comparison site for small business owners, determined that the three states where inflation is hitting hardest are Louisiana, Florida and Tennessee. Besides a regional relationship, these states also share below average median incomes, which means: as prices rise, consumers feel the pinch even more.

- Southern states may have suffered because they have been attractive to new residents. Many Southern states have welcomed population growth or people from the Northeast and West Coast. This was forcing up housing costs even before inflation truly set in.

- The Northeast has gotten off relatively easy. The Northeast has several states least affected by inflation. The region had generally higher prices prior to the pandemic, but the rate of increase there is lower than the national average. Also, higher median household incomes have made any increases easier to bear.

- Some states appear to be ready to handle any economic upheaval. Merchant Maverick recently presented the results of its other study: "The Best States to Survive The Next Recession." Interestingly, several of the states found to be resistant to a recession are also among the ten states suffering least from the current inflation. These states are Nebraska, Wisconsin and New Jersey.

#1. Louisiana

#2. Florida

#3. Tennessee

#4. Georgia

#5. Arkansas

#6. Texas

#7. Alabama

#8. Oklahoma

#9. Mississippi

#10. South Carolina

41. Nebraska

42. Wisconsin

43. Iowa

44. New Jersey

45. Pennsylvania

46. Maine

47. Massachusetts

47. Connecticut

49. Vermont

50. New Hampshire

- Size of state government reserves (17.5%)

- State GDP per capita (17.5%)

- Debt-to-income ratio (17.5%)

- Unemployment insurance coverage (17.5%)

- Unemployment rate (10%)

- Housing affordability (10%)

- State income tax rates (6%)

- Total state GDP change from 2007 to 2010 (4%)

"When we think about inflation, we tend to think of it affecting everyone similarly," says Julie Titterington, Editor-in-Chief, MerchantMaverick.com. "These state-to-state differences in the impact are both fascinating and sobering."

With more than 700,000 page views per month, MerchantMaverick.com is an online publication devoted to providing business owners with accurate, unbiased reviews for their businesses. The company’s goal is to provide the most honest, accurate, and useful reviews of business products and services to empower entrepreneurs with businesses of all sizes.

For more information on this list and this topic, please contact Sarah Johnson, 339031@email4pr.com.

SOURCE MerchantMaverick.com